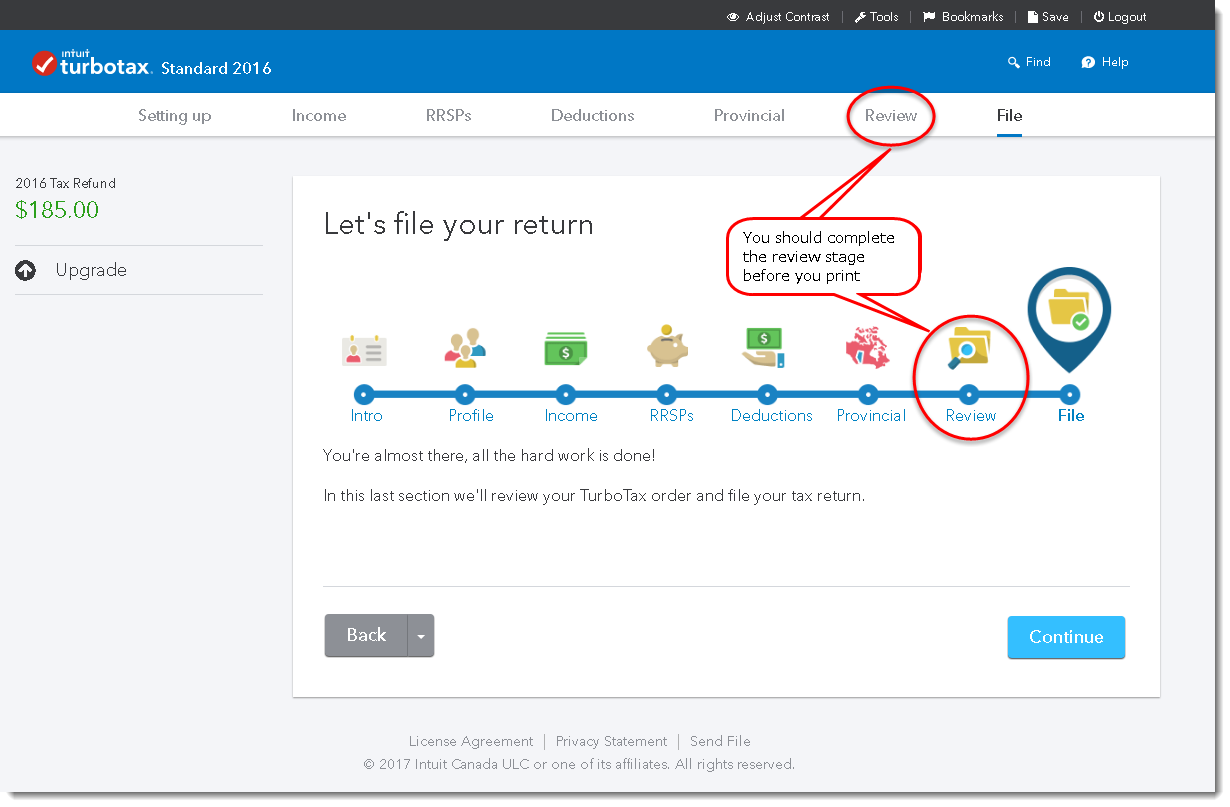

If you used TurboTax Online, you can log in and print copies of your tax return for free. If you filed your taxes with a TurboTax CD/download product, your tax return should be stored on your computer, so you can print a copy at any time.

Once the IRS receives your request, it can take up to 60 days for the agency to process it. You can request copies by preparing Form 4506 and attaching payment of $43 for each one. The TurboTax W2 Finder was created in order to make it easier for taxpayers to access their tax documents.The Internal Revenue Service (IRS) can provide you with copies of your tax return from the most recent seven tax years. If the taxpayer cannot find their form using the TurboTax W2 Finder, they can call customer service for assistance. Once this information is entered, the finder provides a list of possible matches for the W2 form. The finder asks for some basic information about the taxpayer, such as name, Social Security number, and filing status. The TurboTax W2 finder is an online tool that helps taxpayers look up their W2 forms from the previous year. The TurboTax W2 finder is an online tool that helps taxpayers locate their W2 Lastly, if all else fails, you can always request a copy of your W2 from the IRS. If you can’t find it there, you can also try contacting customer support and they may be able to help you locate it. The first way is to go into your account and look for it under the tax documents section. If you want to look up your old W-2 from TurboTax, there are a few ways to get it. The required forms must be printed out and mailed to the IRS as Form 4852 cannot be submitted electronically.

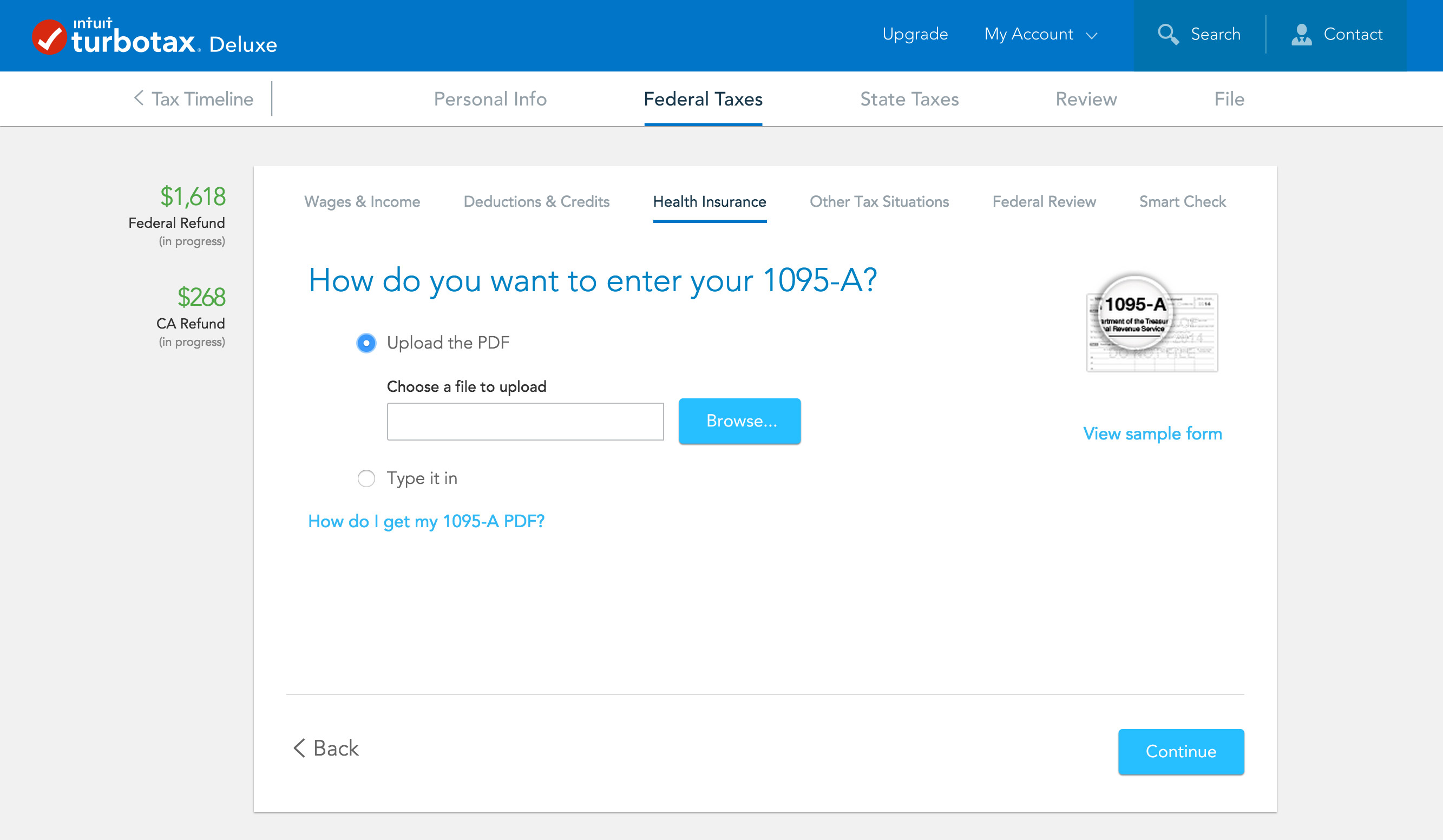

When you use TurboTax, we’ll ask you a few questions to estimate your total earnings and deductions based on your last pay stub, and we’ll fill out Form 4852 depending on the information you provide.

#Print my turbotax return how to

How to file taxes without a w2 on turbotax They either didn’t get a W-2 or their company gave them the wrong one. Taxpayers may use Form 4852 as a replacement for Form W-2 if: Keep in mind that there may be a fee associated with this.Īdditionally, you can fill out and submit Form 4852 if IRS assistance still doesn’t result in getting your W2 and you need to file by the tax filing deadline. You might also need to provide your address and filing status. You will need to provide your name, social security number, and date of birth. If you have not received your W2 by the end of April, you can contact the IRS or state agency to request a copy. They might have sent it to the wrong address or it might be lost in the mail. If you don’t receive your W2 by the end of February, contact your employer right away. The best way to avoid this is to keep your W2 in a safe place. However, it might take some time and you might have to pay a fee. You can still get a copy from your employer. If you haven’t received your W2 by the end of February, contact your employer for a copy. However, it can take up to four weeks for them to be delivered, so don’t wait until the last minute to file your taxes. Your employer is required to send out W2 forms by the end of January. You can also contact customer service if you have any questions or need help getting started. Just make sure that you enter each one under the correct year. Yes, If you have multiple W-2s, you can file them all with TurboTax. Can you file multiple W-2’s with TurboTax

0 kommentar(er)

0 kommentar(er)